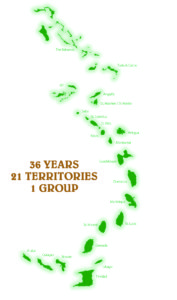

Founded in 1982, The NAGICO Group has grown strategically and organically throughout the Caribbean where it now operates within 21 territories. NAGICO Grenada, having launched 6 years ago is led by Operations Manager Chantelle Bristol and Principal Representative & Accountant Theresa Noel who are both well qualified and experienced in their respective fields. The company offers a family of property and casualty insurance Property, Motor, Marine, Liability as well as health products and risk solutions. NAGICO’s promise and commitment from day one has been to deliver fast and fair service to its customers and to always be there for them; a promise it continues to keep daily. This is the NAGICO way.

Trust is important in life and business. NAGICO protects the trusted relationships with its customers and partners which have fostered its success and created the foundation of the company for the past 36 years. NAGICO’s core values integrity, leadership, empowerment, diversity, and kindness to people, guide its day to day operations.

With a keen understanding of the dynamics and differences around the Caribbean, an exceptional management team and trained staff with a deep understanding of the insurance industry and critical business issues, combined with the strong professional intermediary network it has developed with brokers, agents, and reinsurance partners, NAGICO offers a distinct advantage to its customers. This is evidenced by NAGICO establishing itself as a preferred provider in the Caribbean region and its #1 insurance brand ranking across many of the islands.

NAGICO’s workforce is comprised of qualified and experienced professionals within the underwriting, claims, finance, risk management, governance, compliance, technology and business development areas.

NAGICO FINANCIAL HIGHLIGHTS INCLUDE

• Nearly USD $100 million in Equity

• USD $300 million in Assets

• USD $165 million Gross Written Premiums per annum

• Supervised by 17 regulatory authorities across the region

• Solvent in all 21 Territories within which they operate

• Maintains an exceptional level of risk adjusted capitalization for its business profile as measured by AM Best’s Capital Adequacy Ratio.

• Member of the Fosun Group which has in excess of USD $15 billion in Equity

NAGICO DISTRIBUTION

Over the years NAGICO has built a powerful intermediary network throughout the Caribbean comprised of a diverse group of brokers, agents and managing general agents of varying sizes. This professional network is a crucial part of NAGICO’s strategy to grow and succeed together through sharing core values and honouring promises. The NAGICO network also ensures that an office is nearby to where its customers live and work thus making it easy and convenient for quality advice to be obtained. Each NAGICO representative brings strong technical competence and excellent community knowledge and relations to the fore which helps to actively attract and retain quality business. In addition, this network of professionals has more experience, training, and industry certifications than the industry average in the region, and it has access to the latest technology to streamline and enhance service delivery, thereby allowing them to conduct business faster and easier with its valued customers.

FINANCIALLY STRONG AND RESILIENT

Despite the recent devastation caused by two category five hurricanes, the company has paid 98% of all customer claims from those storms and is working hard to resolve all remaining claims. To date, nearly ¾ billion U.S. Dollars has been paid across the Caribbean by NAGICO to support the restoration process. NAGICO is prudent in managing catastrophe risk exposure with less than 5% of its capital and surplus being exposed to a single event, and has remained financially strong and stable following this trying period due to this judicious risk management approach, which is always at the core of its decision making.

The NAGICO Group grew even stronger when Peak Reinsurance Company Limited, an A-

Excellent rated entity by AM Best and maintaining more than $900M in equity, became a shareholder in 2016.

The company has taken a very stringent due diligence approach to ensure an optimal reinsurance program is in place, with the right partners and coverage selected in order to protect its portfolio of customer policies. NAGICO’s reinsurance program incorporates only the top financial and reputable partners. These partners, Swiss Re, Hanover Re, Partner RE, Lloyd’s Syndicates, and Peak Re together bring in excess of USD $150 Billion in equity to support the group in its risk management.

In fact, AM Best reported that “NAGICO’s balance sheet strength is underpinned by its risk-adjusted capitalization assessed at the strongest level, as measured by Best’s Capital Adequacy Ratio (BCAR) model and a sound reinsurance program to protect capital.” The protection of policyholder interest is of paramount importance to NAGICO.

ONE CARIBBEAN, ONE PEOPLE, ONE NAGICO

Much of NAGICO’s success can be attributed to the company’s core value of ‘integrity’ – one that is upheld by each of its employees. With this value comes the fundamental principle of giving back in order to improve the way of life and enrich the various communities in which the company operates. NAGICO aims to empower the communities through both corporate sponsorships and employee volunteer programs, specifically in the areas of sport, culture and education.

NAGICO Insurance Branch Office GCNA Complex, Kirani James Boulevard, St. George’s, Grenada

T: (473) 438-5000 E: info.grenada@nagico.com W: www.nagico.com